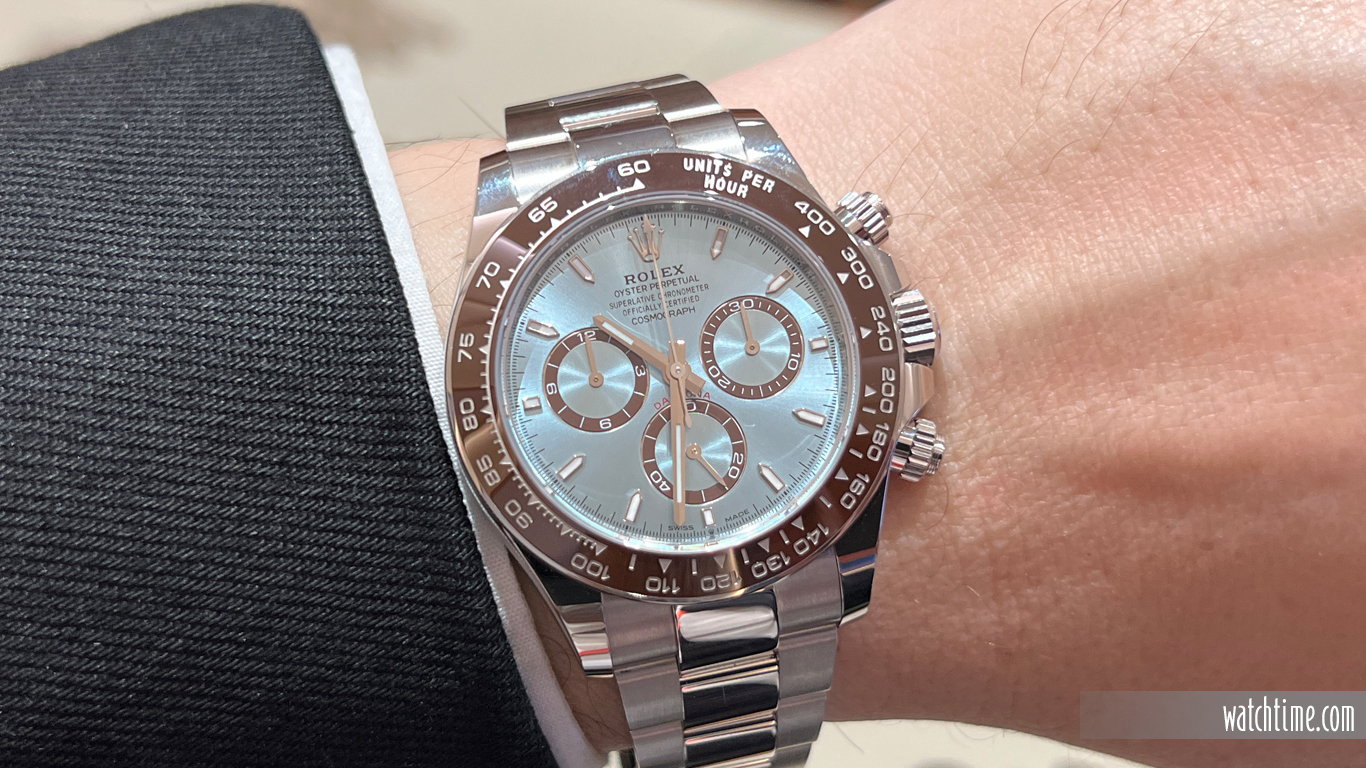

Walk into any watch boutique, browse any collector forum, or flip through luxury auction catalogs, and one timepiece dominates the conversation: the Rolex Cosmograph Daytona. In 2025, it’s not just the most talked-about replica rolex investment – it’s become the gold standard for anyone serious about horological assets.

For many collectors, owning a Daytona isn’t just about telling time – it’s about making a statement while watching their wrist appreciate in value.

This isn’t your typical luxury purchase that depreciates the moment you walk out the store. The Daytona has carved out a unique position where desire meets scarcity, heritage meets hype, and passion meets profit.

Here’s where things get interesting for investors. The numbers tell a story of scarcity meeting insatiable demand, creating a perfect storm for appreciation.

As of 2025, the steel Daytona 126500LN carries a retail price of approximately $16,000 in the US (roughly €15,900 in Europe).

But here’s the kicker – good luck finding one at that price.

The secondary market tells a completely different story, with the same top fake Rolex watches trading for around €25,000 or more, depending on condition and dial configuration. That’s a premium of over 50% above retail price for a brand-new watch.

Data from Bob’s Watches reveals just how impressive the Daytona’s track record has been. Over a 15-year span from 2010 to 2025, the Daytona as a watch category has appreciated approximately 358% from its baseline. To put that in perspective, that’s a compound annual growth rate that would make many traditional investments blush.

What’s driving this relentless demand? It’s a perfect cocktail of factors: genuine scarcity, cultural hype, the broader trend toward steel sport AAA+ clone Rolex watches, the appeal of special dial configurations, and that constant visibility through celebrity and influencer culture.

Each element reinforces the others, creating a virtuous cycle that keeps pushing prices higher.

Perhaps most importantly for investors, the Daytona demonstrates remarkable stability across different market conditions. While fashion fake watches and trend pieces can see their values swing wildly with changing tastes, steel sport Rolexes, and Daytonas in particular, have historically weathered downturns better than most luxury goods categories.

When investors ask about luxury watch returns, the Daytona’s track record stands out, but it’s worth putting those numbers in context against other blue-chip timepieces.

Bob’s Watches data shows the Daytona’s impressive 358% appreciation over 15 years, but interestingly, not the only top replica Rolex watches delivering strong returns. The GMT-Master II actually leads their data with approximately 506% appreciation from the 2010 baseline, a reminder that the sports watch category broadly has been the place to be for investors.

The Daytona’s strength lies not just in its returns, but in its consistency and liquidity. While a rare Patek might appreciate more dramatically, Daytonas trade actively and predictably. You know there’s always a market for your watch, and you have a good sense of what it’s worth on any given day.

Of course, no investment is without risks. Economic downturns could dampen luxury spending, shifts in consumer taste could affect demand, and regulatory or tax changes could impact the market. But the Daytona’s track record suggests it’s as well-positioned as any luxury high quality Rolex fake watches to weather whatever challenges emerge.

For investors serious about adding a Daytona to their portfolio, the answer depends largely on your timeline and risk tolerance. The fundamentals remain strong: limited supply, robust global demand, and a brand that shows no signs of losing its cultural relevance. However, prices have reached levels that require careful consideration of your investment thesis and exit strategy.

Leave a Reply